A Tale of Two Cities

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness…”

Charles Dickens

Corporate Debt v. ABS Issuance

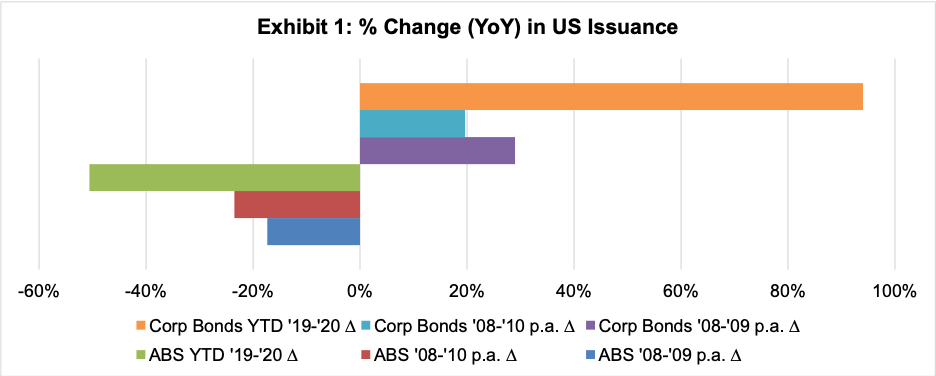

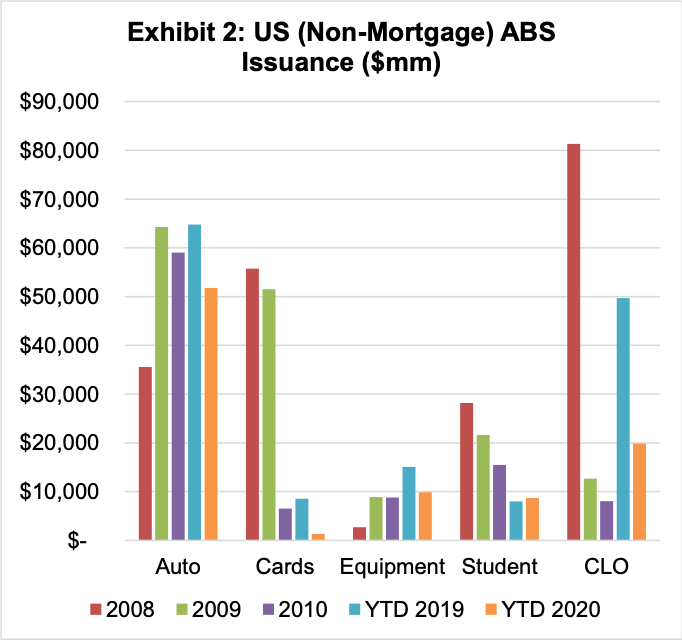

We’ve noted previously that corporate debt issuance has dramatically increased thus far during the Covid crisis as corporations capitalize on stimulative Fed policy and sold record amounts of corporate debt. As can be seen in Exhibit 1, what has also occurred simultaneously, similar to the ’08-’09 financial crisis timeframe, is a dramatic decrease in the amount of asset backed securities (“ABS”) issuance during the same time period (source data: SIFMA; data as of June 2020). In absolute dollar terms the differences of ABS issuance are stark, although it is worth noting some of the distinctions between different collateral types. As shown in Exhibit 2 (source data: SIFMA), in almost each collateral type, ABS issuance decreased meaningfully from ’08-’10 and YTD June ’19-’20. The sole exceptions were automobile and equipment finance during the ’08-’09 crisis period, for possible reasons discussed later.

Possible Reasons and Implications

As we think through the rationale as to why ABS issuance decreases so dramatically, while corporate issuance dramatically increases, there appear to be numerous reasons that come to mind:

- Complexity/cost: ABS securitizations are complex structures, involving not only the investor and originator but other multiple parties including service providers such as rating agencies, trustees, servicers, legal counsel and others. The pooling of large portfolios of financial assets to subsequently tranche out risk through bonds is more time-consuming and expensive than single corporate bond issuance. In a period of high uncertainty, such as the ’08-’09 crisis and Covid periods, time, complexity, and expense may be barriers to issuance.

- Illiquidity: ABS are typically less liquid in terms of secondary market trading than corporate bonds, reduced liquidity which only gets exacerbated during volatile time periods, further reducing the impetus for new issuance.

- Reduced collateral pools: During volatile periods when corporate issuance can in large part be aided directly by Fed stimulus, the Fed can only indirectly assist the ABS market (via its Term Asset-backed Loan Facility, “TALF”); however the Fed has little ability to directly assist in the creation of the underlying collateral pools (auto finance, student loans, etc.) issued by specialty finance companies aggregating such financial assets. In fact, during most volatile time periods, such specialty finance companies typically tighten up their underwriting standards such that their origination of asset pools (which would subsequently serve as collateral for securitizations) dramatically decreases. Anecdotally, we have been in discussions with many originators who have either reduced or altogether stopped asset originations. With lower amounts of collateral pools (the “raw material” for securitizations), ABS issuance is reduced.

- Conservatism: Another reason for reduced securitizations is due to investor concerns regarding payment continuation. While the continuous cash-flowing nature of ABS collateral pools lend themselves to structures providing monthly interest payments and amortization, to the extent those collateral cashflows become uncertain, ABS investors may no longer feel comfortable with the probability of those cashflows. In comparison, corporate bonds are typically more lenient, generally with balloon payments upon maturity and quarterly debt service schedules, potentially even including PIK features in the early years—thus providing more time for corporates to recover and make their payments.

We noted earlier that auto and equipment ABS did not decrease during the ’08-’09 crisis. Possibly the hard-collateral nature of auto/equipment provided a measure of safety, above and beyond typical collateral cashflows, which may explain the continued demand and supply of such issuance in 2009 and 2010. Thus far in 2020, however, we have not seen the same phenomenon replicate, although we are still early in 3Q20.

It remains to be seen for the remainder of 2020 whether there will continue to be such a wide divergence between corporate and ABS issuance. We look forward to monitoring the macro market trends and of course, evaluating transactions on a deal by deal basis as we encounter them.

VION Transactions

Though the supply and demand for conventional publicly securitized assets may have decreased during the Covid timeframe, VION continues to underwrite and transact in private financial asset portfolios. In numerous cases, we note that our capital investments to originators provide liquidity in a similar manner to what a public securitization might otherwise provide (if public securitization of such portfolios was reasonably feasible during a post-Covid time period). Through our combination of capital, expertise, and experience with all types of financial assets, we look forward to helping to solve any finance company’s liquidity concerns.